Many prominent people have advocated that the IMF undertake an “SDR allocation” to assist countries in dealing with the global financial crisis brought about by the COVID-19 pandemic. To most experts, the idea seems like a no-brainer, but some IMF shareholders have voiced concerns, particularly the United States, which has a controlling vote in the matter. If IMF shareholders show some leadership and bureaucratic flexibility, there are ways to allay the American government’s concerns and quickly get liquidity in the hands of countries who desperately need it.

What is an SDR allocation?

In the late 1960s, the IMF was empowered by its shareholders to issue Special Drawing Rights (SDRs)that the central banks of all IMF members hold in their accounts as reserves. If a country is running low on currency to pay its foreign obligations, say dollars or euros, it can exchange its SDRs for the needed currency.

Just as a central bank can print its own currency, the IMF can create SDRs. This is not something that is undertaken lightly—it requires a vote of at least 85 percent of the total votes held by IMF members. And the United States holds 16.51 percent of the votes, so its agreement is essential if more SDRs are to be created. New SDRs have been created several times in the IMF’s history.

When the IMF creates more SDRs they are given (allocated) in proportion to each country’s shareholding (or quota) in the IMF. (For technical reasons, “quotas” and votes are not in exactly the same proportions). So, the United States would be allocated 17.45 percent of any newly created SDRs and Guinea, for example, would get 0.05 percent (a table of quota shares can be found here).

Once a country receives an allocation, it can hold it in SDR form or ask for it to be converted to usable currency by selling all or part of it to another member or designated purchaser. If its current holdings of SDRs are less than its total statutory allocation, it is charged 0.5 percent interest on the difference. Conversely, if a country holds more than its statutory allocation, it receives 0.5 percent interest on the difference (a table of current SDR allocations and holdings can be found here).

Why are many calling for a new SDR allocation now?

A new SDR allocation would allow countries running into foreign exchange reserves difficulties to access hard currencies at a low interest rate—much lower than borrowing on international markets. This added international liquidity injects grease into the international financial system at a time when many of the gears are freezing up.

With the disruption in the global economy caused by COVID-19, many countries needing to ramp up spending to confront the crisis do so in the face of collapsing economies and tax revenues. This is not easy for any country, but it is particularly difficult for emerging and low-income countries whose economic livelihood is heavily dependent on trade. They use the foreign exchange they earn from exports (so-called hard currencies, like the dollar, euro and yen) to purchase needed imports for their citizens. With the collapse of trade, that income is gone, and countries are drawing on their reserves of foreign exchange, which in many cases are scarce. When foreign exchange reserves run out, a country’s ability to purchase abroad does too, and citizens will starve.

Given the fluidity of the global economic situation, it is difficult to get precise numbers on how much foreign currency inflows and outflows will be in the coming months. But various estimates paint a dire picture. Comparing the IMF’s April 2020 World Economic Outlook to that of October 2019, we estimate that an unexpected drain on low- and middle-income countries from trade (the current account balance) in 2020 will be in the order of $230 billion, with a median deterioration of about 3 percent of GDP.[1] Separately, the World Bank is projecting a 20 percent drop in remittances from low- and middle-income country citizens living abroad to their home countries—and even more for sub-Saharan Africa—a reduction of about $100 billion in inflows.[2] At the same time, international capital markets are also withdrawing financing from these countries. One set of estimates puts outflows from emerging markets since January at $97 billion ($83 billion in March alone); flows in 2020 to emerging markets are forecast to be about $500 billion less than in 2019.[3] All these sources project some recovery in 2021, but nowhere close to pre-COVID levels.

What is the proposal on the table?

The proposals for a new SDR allocation range between the equivalent of $500 billion to almost $4 trillion, with some consensus emerging around $1 trillion. A $1 trillion SDR allocation would give low- and middle-income countries an additional $330 billion in reserves. Larger or smaller allocations would scale that figure proportionately.

What is the resistance to the idea?

The first argument usually offered against it is that an SDR allocation is the equivalent of printing money and thus, in the face of weakened demand, might cause inflation. Most economists think this is not the case (see, for example, Ted Truman’s cogent arguments). Global reserves are about $11.5 trillion and global money supply is just under $100 trillion. So up to $1 trillion increases global reserves by less than 10 percent, which does not seem enormous given the size of the stimulus needed to spark economic activity again and the size of the various packages being put forward by developed nations, which total in the trillions of dollars.

The second, and more compelling, objection is that the distribution of the allocation among countries will not bear any relation to their real needs. If the total allocation were $1 trillion, the largest amount would go to the United States—$174.5 billion. But the United States can print its own money and swap with other major nations for other currency needs, so why create SDRs? The same can be said for Japan, the eurozone countries, China, and other large developed countries—all of whom will be the big recipients.

Looking at the SDR allocation by country groupings illustrates the distributional concern well.

Table 1. SDR allocation by income group

| Income Group | Current Allocation | Current Holdings | New Allocation | New Holdings* |

|---|---|---|---|---|

| Low income | 4.52 | 1.90 | 14.06 | 15.96 |

| Lower middle income | 24.14 | 11.67 | 85.85 | 97.52 |

| Upper middle income | 55.25 | 45.82 | 229.99 | 275.81 |

| High income | 193.68 | 186.49 | 670.10 | 856.59 |

| Grand Total | 277.59 | 245.89 | 1,000.00 | 1,245.89 |

Source: IMF Finances.

All numbers in billions of USD.

1 USD = 0.735455 SDR

* Assuming countries hold their entire additional allocation.

The first column of the table shows the dollar value of the current statutory allocation of SDRs. Countries are free to buy and sell SDRs to each other, to the IMF, and to other designated buyers, and thus actual holdings (shown in the second column) differ from the initial allocation. It is worth noting that inpercentage terms, low-income and lower-middle-income countries have used considerably more of their allocation than countries in the two higher income groups.

The third column shows how a new SDR allocation of $1 trillion would be divided up among the four country groups. If left untraded, the new holdings are shown in column 4 (proportions between current and new allocations are different for technical reasons).

High-income countries get the bulk of the allocation, but with the extra $1 trillion, as noted above, low- and middle-income countries would get a $330 billion boost in reserves, which could be converted to a tradeable currency at a cost of 0.5 percent per year.

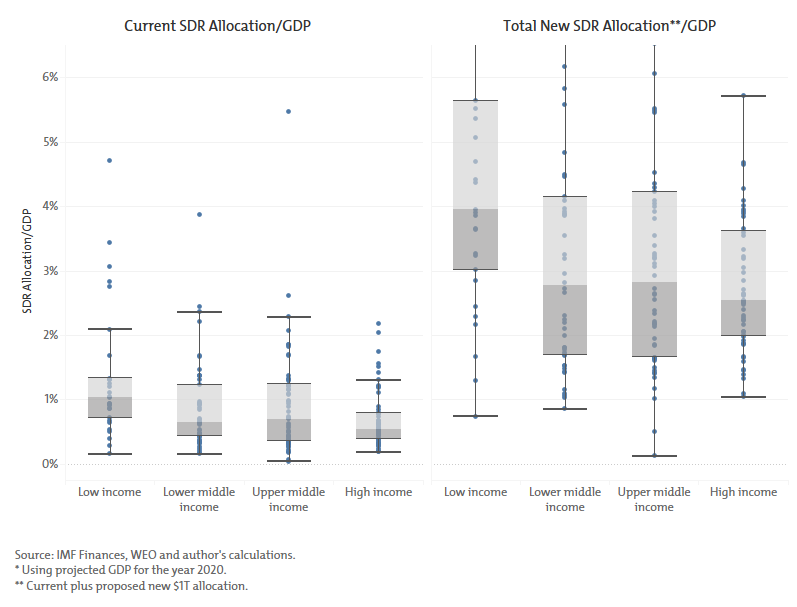

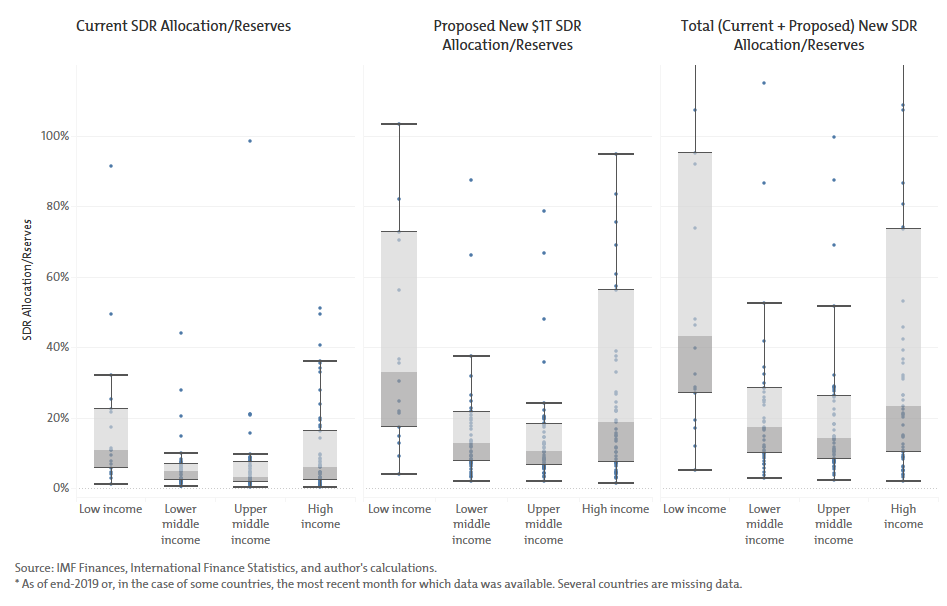

IMF quotas are already somewhat tilted toward low- and middle-income countries relative to their share in global GDP, so they would benefit a bit more proportionately, both in terms of the SDR allocation relative to GDP (figure 1) and in the relative boost of reserves they receive (figure 2).

Figure 1. Distribution of SDR allocation as a share of GDP* by income group

Figure 2. Distribution of SDR allocation as a share of reserves* (excluding gold) by income group

But relative to need, is this simple SDR allocation sufficient? Upper-income countries stimulus packages are varying between 4 and 20 percent of GDP so far. If the SDR allocation were aimed at augmenting low- and middle-income countries’ reserves by 10 percent of GDP (table 2), almost $500 billion would be needed for low-income and lower-middle income countries (excluding India) alone and almost twice that much for upper-middle-income countries (excluding China and Venezuela). So some redistribution of the initial allocation would be needed to target those countries least able to face a drain in their reserves.

Table 2. SDR allocation needed to get to 10 percent of GDP* by income group

| Income Group | Current Allocation | Proposed New $1T Allocation | Allocation Needed to Get to 10 Percent of GDP** |

|---|---|---|---|

| Low income | 4.52 | 14.06 | 49.53 |

| Lower middle income*** | 18.73 | 58.28 | 429.07 |

| Upper middle income**** | 42.29 | 158.07 | 963.68 |

| Grand Total | 65.54 | 230.40 | 1,442.28 |

Source: IMF Finances and author’s calculations.

All numbers in billions of USD.

1 USD = 0.735455 SDR

* Using projected GDP for the year 2020.

** On top of the current allocation.

*** Excludes India.

**** Excludes China and Venezuela.

What might be a better way?

IMF member countries are free to lend or even donate their SDR allocations to other countries—so, for example, Germany could give Kenya part of its allocation to comfort Kenya’s reserves position. This is not costless for Germany, as it would have to pay 0.5 percent per annum on the shortfall of its actual holdings from its statutory allocation. Germany could either absorb that cost as a “gift” to Kenya or pass the cost onto Kenya. Either way, Kenya gets access to even more foreign reserves at a bargain-basement interest rate for an emerging economy country.

If powerful developed countries do not like the idea of an additional allocation because of its distribution, they can pre-arrange to effect a different distribution after the new allocation is made.[4] Any number of reallocation mechanisms could be envisaged going from upper-income to developing countries, but whatever is chosen should be agreed in advance of the SDR allocation and be somehow proportionate to the burden faced by the recipient countries. For example, the reallocation could be proportionate to the IMF-estimated current account degradation resulting from COVID-19 in the current World Economic Outlook.

The politics of coming to such a deal is complex—an 85 percent majority is needed only for the SDR allocation to take place; once it takes place countries are free to do as they wish. But if an a priori agreement on a reallocation is needed to garner the 85 percent majority, countries will insert their own political agendas into the discussion on the reallocation mechanism. There is likely to be pressure to exclude some countries viewed negatively for governance or geopolitical concerns from receiving a reallocation, or even to deprive them of their new allocation. So some political sweetener may be helpful (see below).

To push a new allocation through the political process will require leadership to hammer out an agreement, which is likely to come from high-income countries, and flexibility to overlook political mandates, remembering this is a short-term emergency action that will benefit all, not a play for long-term power. In all of this speed is of the essence as a liquidity boost can help stop economic hemorrhaging. This argues for a reallocation mechanism based on data that are already available, perhaps with a rules-based adjustment later on.

The G20 seems the best existing forum in which an agreement could be reached, although the latest communique from finance ministers and central bank governors noted in a footnote a lack of consensus surrounding the issue. Resources of high-income countries willing to donate some part of their new allocation could be pooled and then reallocated according to the agreed mechanism. Given the uncertainty of the current economic situation, it would be advisable to hold back some of the reallocation for a second round once the actual impact of the crisis becomes evident.

What are some alternative uses of an SDR allocation?

It might also be economically (and politically) useful to use some part of the new allocation in innovative ways to ensure that urgent global needs are being met, particularly by getting longer-term low-cost assistance to poor countries and ramping up global investment in health systems, vaccines, and technology. Two alternative proposals for use of a new SDR allocation start from the premise that a country’s SDR allocation is part of its foreign reserves and the country is free to spend the money as it sees fit—including for development purposes. Both these proposals push at IMF orthodoxy, but central banks around the world are bending their practices to find novel solutions to today’s unprecedented crisis.

In the past, several developed countries have transferred some of their SDR allocation to the Poverty Reduction and Growth Trust (PRGT) trust fund that the IMF uses to finance concessional operations in low-income countries. These funds provide the capital for a revolving loan fund to low-income countries that helps them address the longer-term problems that they will face in the aftermath of the current crisis. The fund is designed to be self-sustaining and thus the SDRs that serve as the PRGT’s capital would not be depleted over time. The fact that the SDRs stay institutionally within the IMF lends some assurance to that effect. In the context of the current crisis, the IMF is seeking another $7 billion in funds for the PRGT, which could easily be accommodated from some high-income countries’ new allocation.[5]

Drawing on an IMF staff paper, my CGD colleagues Nancy Birdsall and Ben Leo take this one step farther, examining ways to use SDR allocations to fund green investment. But their proposals would be equally applicable to the current health crisis, where investment in health systems, technology, and research is sorely needed in short order. In simple terms, the idea would be for countries to pledge some part of their SDR allocations to provide the initial capital for a COVID-19 response investment fund. The fund would issue bonds based on the SDR capital and undertake investments in projects related to the COVID-19 crisis, such as vaccine production or health technology. To the extent the fund was commercially viable, the SDRs would not be encumbered and thus could remain part of the pledging countries’ reserves. However, given that the objective of such a fund would likely be to finance projects that international capital markets might find too risky, or whose returns were too diffuse over time and across countries to be monetized (so-called global public goods), a mix of loan and grant financing would be needed. Thus, in addition to the SDR allocation capital, the fund would, in due course, need to find supplementary grant money.

Why can’t all this be done with the existing allocation of SDRs?

We have argued that the basic objection to a new allocation of SDRs—its distribution—can be overcome either through an ex ante redistribution or directing portions of allocation to other uses either within the IMF (low-income countries) or outside (a health technology fund). But why wait? There is, after all, a pool of SDRs already there. Why not use that pool for any of the purposes proposed above?

Indeed, discussions on a reallocation framework and on extending the use of SDR capital should start now. Countries who are willing to reallocate existing SDRs should be seeking a framework to do so—quickly.

But there are two good reasons to push for a new allocation quickly:

- The size of the current allocation, about $280 billion, is inadequate to the task. The potential outflow of reserves from current transactions alone for middle-income countries is at least on the order of $300 billion over the next two years, to say nothing of the loss capital flows. And upper-income countries are confronting problems that are even larger—within their current reserves they are unlikely to have the financial or political flexibility to come to the rescue of emerging and low-income markets with the amounts needed.

- It is always easier to spend a windfall than redirect existing money. A framework is needed where at least 85 percent of the IMF membership sees themselves as “winners” politically or financially to get the new allocation to happen. This is going to be much easier to do when the pot is growing, not fixed.

The choices

SDR allocations are designed as reserves to be used on a rainy day, and we are now in the middle of a category 5 economic hurricane. By design, it is difficult to use SDR allocations, but it needs to be done. High-income countries are bringing all their resources to bear to make it through the storm, but low- and middle-income countries do not have the tools or resources to get similar protection. An SDR allocation is an almost costless way for the international community to extend a financial umbrella to them. In the end, there are four option beyond inaction—from mediocre to good to better to best.

- Reallocate existing SDRs from high-income countries to some subset of low- and middle-income countries. Why mediocre? The existing resources are not nearly enough to begin to cover reserve loss, and the political and technical costs of doing this are the same for the better solutions.

- Implement an SDR allocation of $1 trillion, with no subsequent reallocation—countries get their share according to current IMF rules. Why good? It increases the reserves of low- and middle-income countries at a very low cost. Why not better? It increases every country’s reserves, including high-income countries who do not necessarily need the firepower. It also gives reserves to some countries where geo-politics makes reserve allocation unpalatable, thus making the option impossible to implement given the 85 percent voting requirement.

- On top of the new SDR allocation scheme, design a scheme that reallocates to the low- and middle-income countries that need the extra reserves the most. And some part could be used for the IMF’s loan pool for concessional loans for low-income countries. Why better? If the reallocation can be focused on those countries truly in need, it overcomes the objection that the rich are being helped more than the poor, giving political cover for geo-political concerns.

- Use some (not all) of the SDR allocation to capitalize a fund to provide for health-related public goods. Why best? A big part of the current crisis is the lack of a global infrastructure to fight the virus—country-by-country efforts will slow the virus, but a global effort is needed to defeat it. This includes global financing, which requires global capital. SDRs can provide that capital. Using SDRs to mobilize financing for health research that serves all of humanity deflates the argument that the SDR allocation is favoring one country or another.

Asad Sami assisted in preparing this note. It has benefited from discussions with David Andrews, Matthew Fisher, Nancy Birdsall, Nancy Lee and Scott Morris. The author is solely responsible for its content.

[1] These data are for those countries whose current account balance is expected to decline. The calculations exclude China and India. Venezuela and Argentina are excluded given that their economic situation and data reporting leave projections highly suspect. Data for Syria is not available.

[2] There is not enough detail in published figures to know the extent to which IMF current account projections fully incorporate the World Bank’s remittance projections.

[3] There are some signs of continued appetite for bonds from upper-middle-income countries, with recent issuances from Indonesia, Mexico, Peru, and some Middle Eastern countries attracting considerable demand.

[4] The IMF has considered alternative uses of the SDR including reallocation mechanisms.

[5] Such a use of funds would be subject to each high-income country’s rules regarding use of reserves and thus may not be uniformly appealing to all countries.